“Good checklists, on the other hand, are precise. They are efficient, to the point, and easy to use even in the most difficult situations. They do not try to spell out everything–a checklist cannot fly a plane. Instead, they provide reminders of only the most critical and important steps–the ones that even the highly skilled professional using them could miss. Good checklists are, above all, practical.” – Atul Gawande.

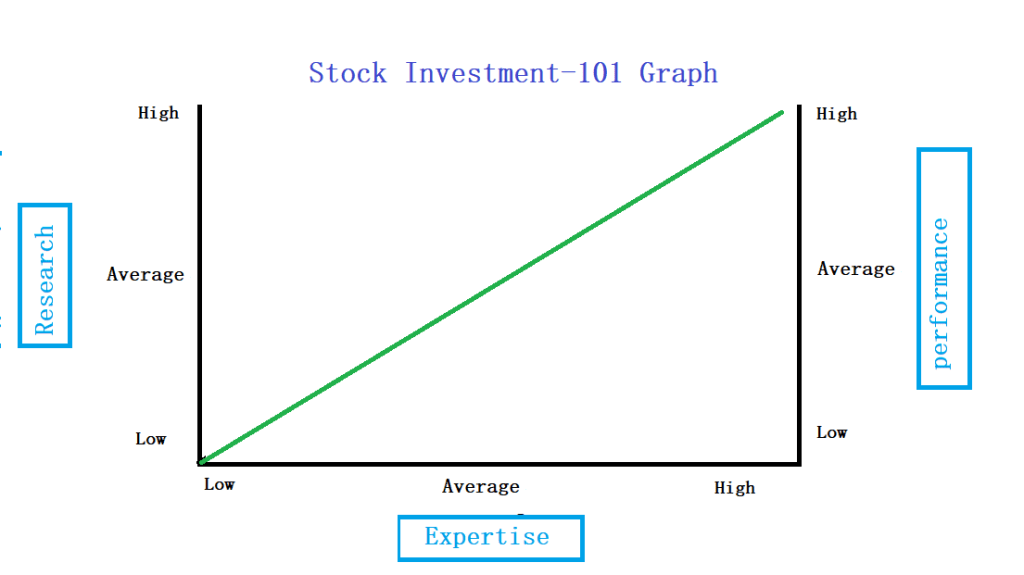

Investing is easy but good investing is very difficult. The proof – Majority of investors (retail and professional) do not beat the benchmark index. Most retail investors do not have time to do extensive research and do not possess expertise (Financial and Behavioral) to get outstanding performance. Therefore, we tend to do a little research and possess low expertise which, indeed, results in a bad performance.

Is there a way to alter this?

Despite having good expertise and performing extensive research, professionals often have a bad performance. Professional, oftentimes, are biased. They act in their own favor rather than their customers’ favor. It is beneficial to professional money managers to find reasons to make investments rather than asking their customers to wait if the investing condition is not in investors’ favor. Their poor performance is mainly because of two reasons.

- Short term thinking

- Too many unnecessary transactions

Well, we have created minimum guidelines on both research and expertise, so that, retail investors can outperform the benchmark and the professionals. However, this checklist is just basic guidelines to get the investors to think in the right direction. Investors should consider so many things to make the right judgment. This will provide a framework to not to avoid any important steps in making those calls. It is also useful to review any positions that investors alread have in their portfolio.

Is it really possible? I think so.

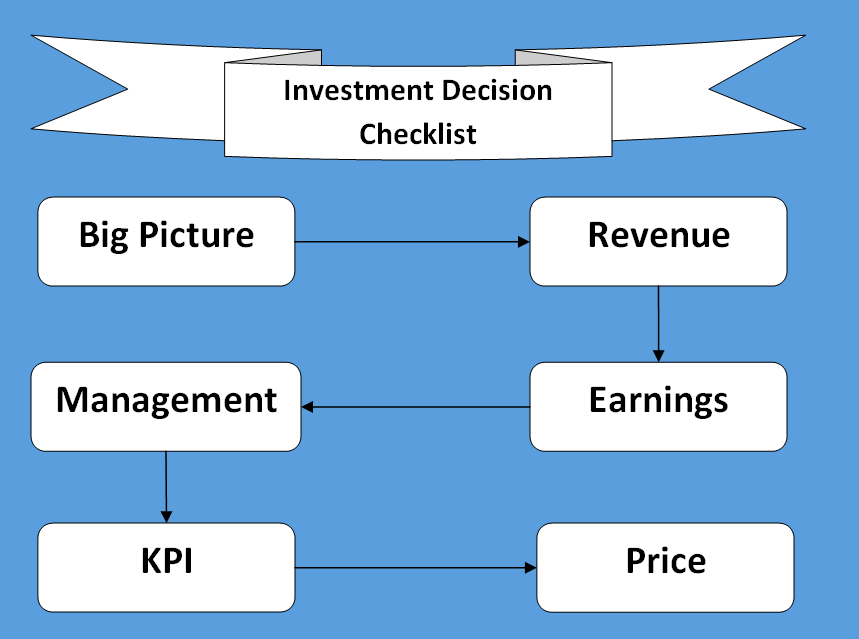

I will walk you through the simple six steps process which includes both research and expertise. You don’t need to be a genius to understand this.

Big Picture

- What does the company do?

- Is it in a growing industry or shrinking industry?

Revenue

- Where does the revenue come from?

Earnings

- Where does its Earning go?

Management

- Do you believe and trust the management team?

KPI

- Return on Equity

- Return on Assets

- Debts

Price

- How much is it selling for?

If retail investors can answer the above questions in very detail and accurate fashion, they are bound to perform better. Assuming that you invest for a long term abstaining from unnecessary transactions. From this point, investors should ask and answer other related questions. The more the questions the better the result. These are the absolute minimum guidance to investors of our circumstances, who are working full time and have no background in finance.

A checklist investing is probably the safest way to invest. Althoug, you will have to make sure to follow the right checklist. A proper checklist helps an investment to become a good investment, but it is not guaranteed. Sometimes a good process results in a bad outcome. Don’t blame it on the process, though!