Fastly is an American cloud computing services provider. It bears all the characteristics of modern economy as the Wall Street says it. It is cloud based company; It has subscription based revenue model; It requires light capital for growth and so on.

I might add that it has other less popularized traits of the modern economy i.e. it is unprofitable and bleeds cash like the Niagara Falls in the rainy season!

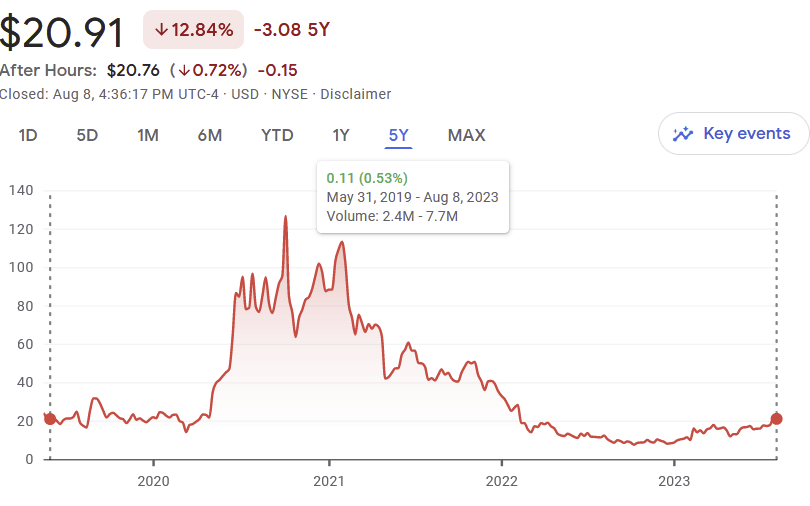

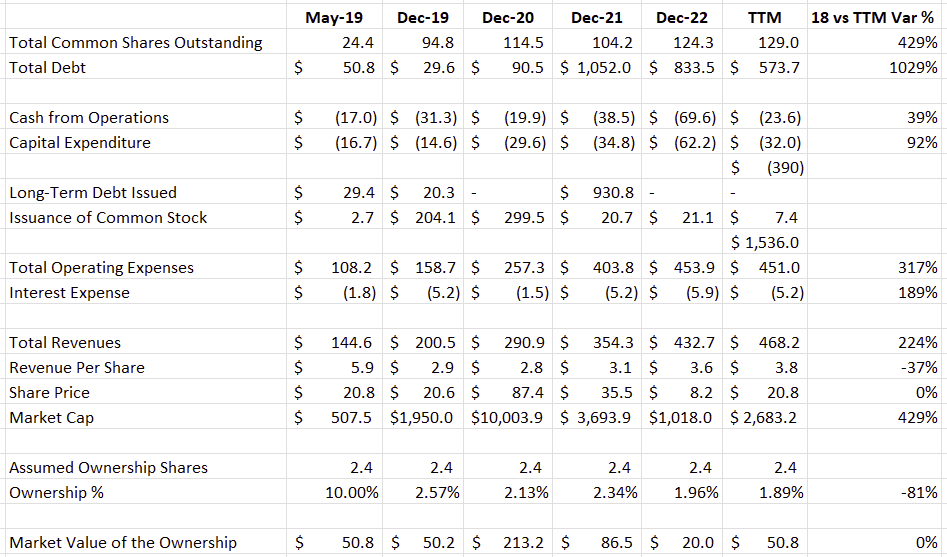

It went public in 2019 for 507.5 million dollar total Market Capitalization (End of May price are used for calculation). Fastly is registered under the ticker NYSE:FSLY . Their stock opened with $16.00 in its May 16, 2019 IPO. The stock closed at 20.80 on May 31, 2019. Incidentally, today (08/08/2023), the stock is at 20.80 also. Today, the whole company is traded for 2.6 Billion dollar, a gain of 429% in five years.

Did the owners of Fastly really did gain 429%? Lets find out.

Lets assume you, a Modern Capitalist, owned 10% of its share on May 2019, which equals to 2.44 million shares. Market value of your ownership would be $50.8 million. Today, your ownership percentage has reduced to 1.89% because of issuance of new shares.

In the last 4 years, they issued around 105 million shares. More than 4 fold of what they had in 2019. Dilution is in prime state at this modern company.

Although, their market capital has gone up four fold, your market value of your ownership would still be $50.8 million.

In those years, their Total Revenue did grow 224%. However, observer the Cash from operations; It is all negative. More capital must be injected to continue the operation and fund the capital expenditure. As you may have predicted, those extra fund comes from the Debt, which went up 10 fold from $50.8 to $572.7.

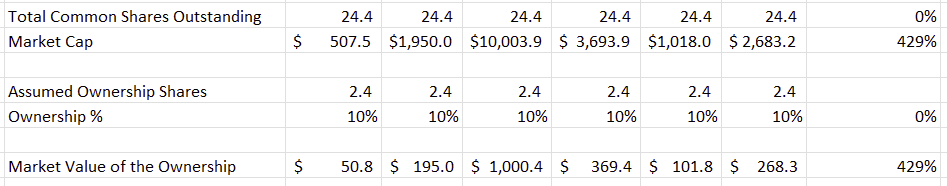

What if they didn’t issue any new shares?

If the company had not issued any new share, market value of your 10% ownership would be $268.3 million today, an increase of more than four fold.

Under the hood, this is the reality of the modern company of the so called modern economy.

Long-term oriented Investors ought to be careful of the effect of Dilution. It is the termites of the modern economy. You may not see them, but they are there! It eats away the most solid of the companies.