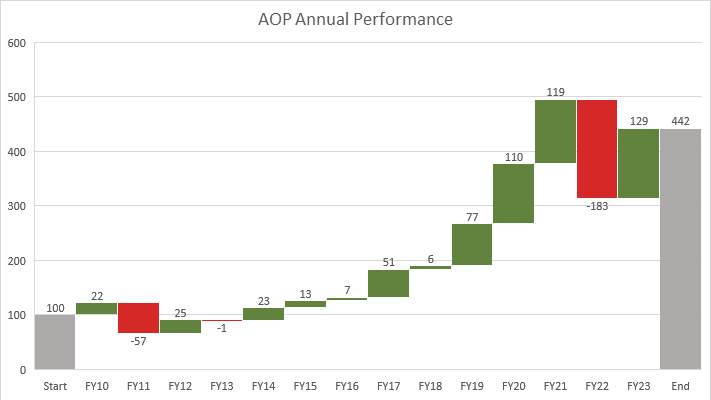

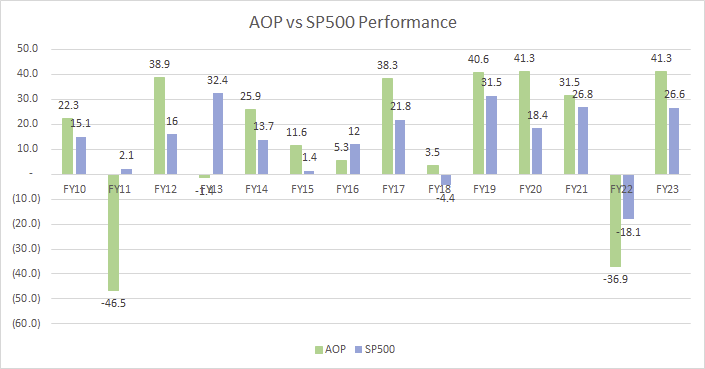

In year 2023, AOP gained 41.3%, whereas S&P500 gained 26.6% (including dividends reinvested). It was a fabulous year for the stocks compared to year 2022, perhaps because of the low starting point.

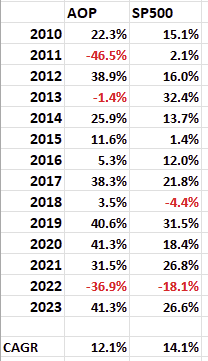

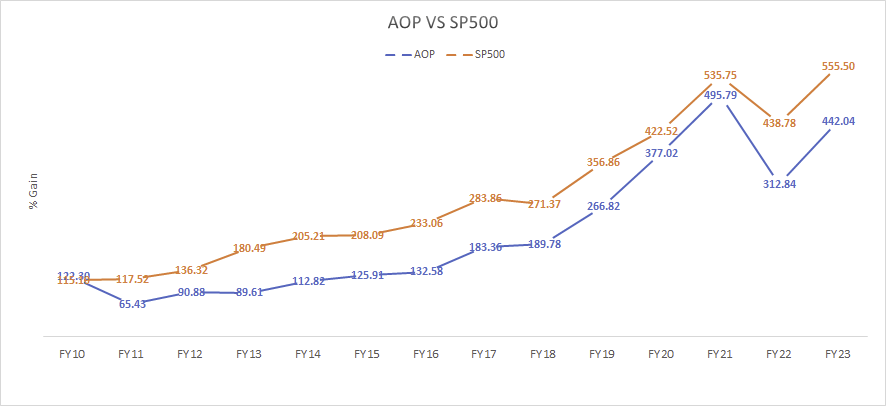

Below figure shows how AOP is performing since the start. Although, we have seen some blockbuster years, the all-time result is below the market. Since 2010, the compound annual growth rate for the fund is 12.1% compared to 14.1% for S&P500.

In 13 years, $100 invested in AOP will give you $442, where as S&P500 gives your $555.5. A clear under-performance for AOP!

Here is the annual ups and downs comparison in bar chart.

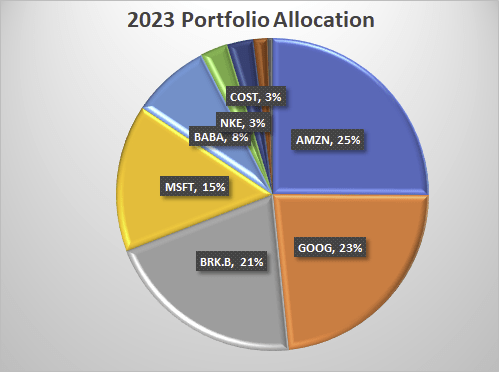

Portfolio Allocation

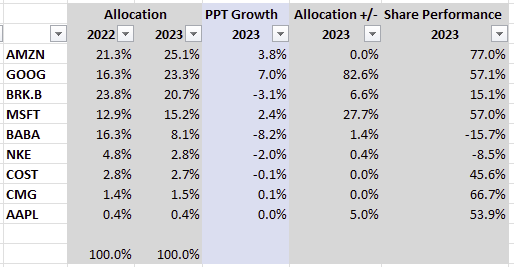

Our portfolio allocation hasn’t changed much in year 2023. Our top 5 holdings are still the top 5 holdings. Those 5 holdings represents over 90% of our portfolio.

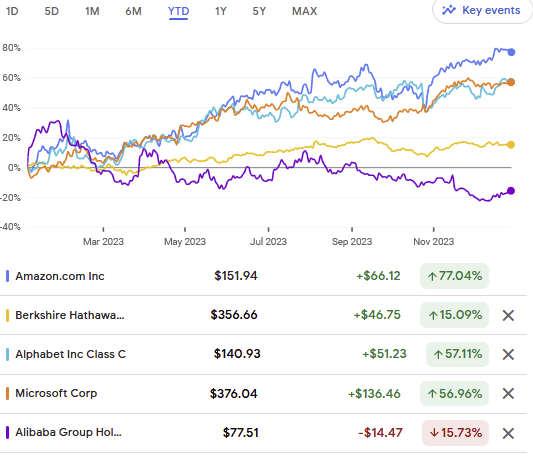

We upped our allocation on Alphabet, Berkshire Hathaway, Microsoft and Alibaba. Amazon is moved to #1 spot because of 77% gain in year 2023 without having to increase the allocation. Berkshire slipped to #3 with just 15% gain. Alibaba is still the #5 but with just 8% overall allocation because of its -15% loss.

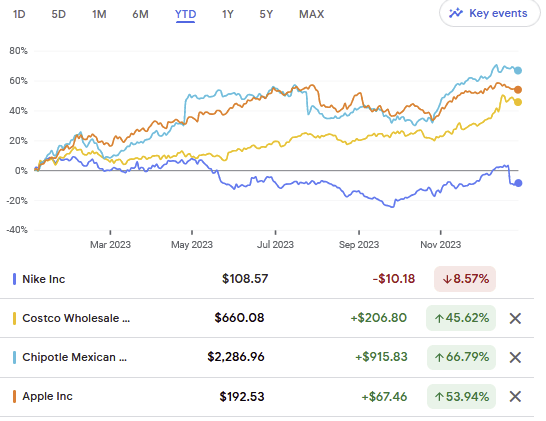

Rest of the small holdings didn’t have enough allocation to move the needle despite their astonishing gain this year.

Our favorite metric has moved a year. Our average holding period is now 5.3 years up from 4.3 years. Amazon, our longest holding, is now also the largest holding without adding a single dollar on it in 2023.

This metric helps us slow our activities. We are proud to say that we have no realized gain/loss in year 2023. We were only on the buyer side of the transaction in year 2023.

Alibaba is now just 8% of the portfolio from 16% in 2022. Their revenue is down slightly, although their earnings went up quite a bit. It is going through some tough time partly because of the macro economy in China. We still believe that it is trading in discount to what it is actually worth. We got to give some time for the Chinese economy to bounce back and the new initiatives of the newly appointed CEO, Eddie Wu, to kick in. Wu, who is also one of the co-founder, seems like a Level-5 leader. Here is a highlight of his transformation logic.

Each business will be labeled “core” or “non-core”, based on its market size, business model, and product competitiveness. Core businesses will receive attention and resources. Non-core businesses will be spurred to hit profitability or be monetized to return their capital to shareholders.

This is exactly what I would do if I were the CEO of Alibaba!

If things work out as expected, from this low level, it may not be too crazy to expect 10X in 10 or so years. Alibaba’s cloud computing will help it become a trillion dollar company!

There are three avenues of growth for Alibaba to hit that crazy 10X performance.

- PE expansion – Currently, it is trading for PE of less than 10. In the normal market, if it trades for 20 times Earnings, the shares price double. If it trades at 30 times, it triples! Just so you know – it’s counterparts in US trades for 40 times.

- Shares buyback – Currently, they have approximately 20.3 billion ordinary shares, a reduction of 138.9 million ordinary shares from last quarter and US$14.6 billion remained under the current share buyback program. Overtime, we expect the total shares to be less, which will increase the earnings per share.

- Earnings Expansion – We see the new management is quite focused in hitting the profitability for the non-core businesses and focusing on growth initiatives for core businesses. This indicates to increasing earnings in the future. We might see increase in Profitability because the current management has the goal of hitting the ROIC of double digit from the mid single digit.

Here is the icing on the cake – they have announced a one time dividend of $1 per ADS for 2023. Although, it is painful to see shares sliding from this low level and under-performing the market by 40%.

Visualization of the wild ride of price history.

Expectation

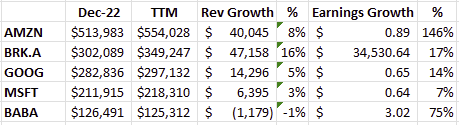

All the big holdings had decent revenue and earnings growth in 2023 and we expect them to do the same thing for years to come. Therefore, we see no need to do anything with those.

Our goal for 2024 is to just lean back and enjoy the ride!

Although, there will be wild fluctuations from year over year or quarter to quarter, their earnings are expected to grow in the long-term. Here are some of our watch-list.

In 2024, we expect to not be as big buyer as in 2023. Partly because the market has appreciated quite a bit already and partly we have borrowed from 2024 to invest in 2023 when the market was low. Our wage income will be served to pay off those borrowed amount, which, fortunately, is already working for us.

Speculation

We would be lying if I say we stayed sane all year long. Although, it is true for the first 11 months of the year. On the 12th month, our itchy figures couldn’t resist and we speculated on few new endeavors.

We expect to close those positions in the first half of the next year. One of those speculations is Erricsson, which is already up 15% from our purchase point. It earned a new contract with AT&T for $14 billion and the whole company was selling for $13 billion. Currently, it sells for $20 billion. We believe the company is worth around $25 billion. It has its own sets of challenges, but we saw a quick opportunity to grab.

To make the matter worst – we had initiated this position on margin loan. If things stay the same, we hope to capture a decent return on this trade after interest and tax.

Happy investing!