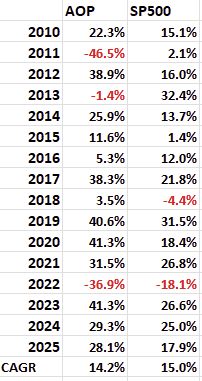

Arrow of Performance (AOP) was up 28.1% in 2025; Compared to 17.9% for S&P500. We did well this year but from the inception date, we are behind.

AOP compounded annual growth rate since 2010 is 14.2% compared to 15% for S&P500.

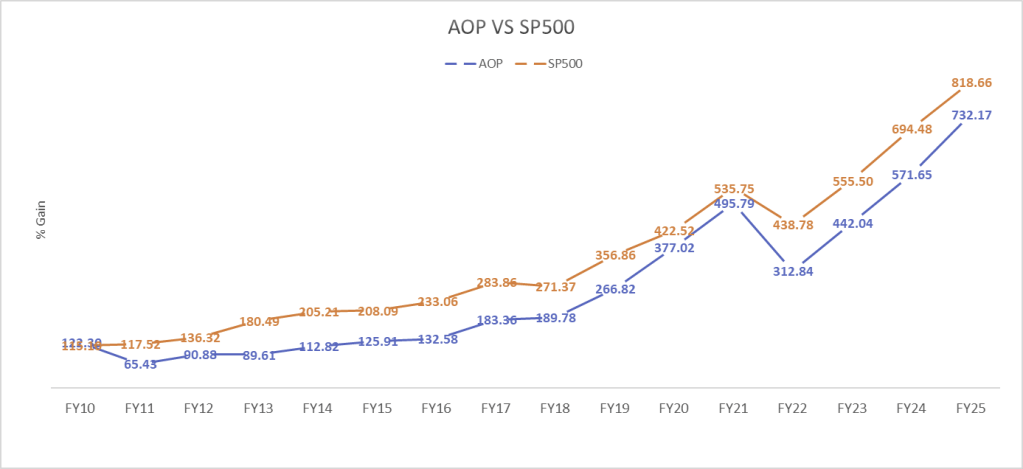

$100 invested in AOP vs S&P500 since the inception date. S&P will yield you almost 100% better performance.

Although the math here in terms of dollar is not this straightforward. We have 81% of our capital invested in the last 10 or so years, where we are beating the market by a decent rate.

The total performance here is based on the our initial $100, but the annual performance is based on the total investment i.e. initial fund and incremental additional fund.

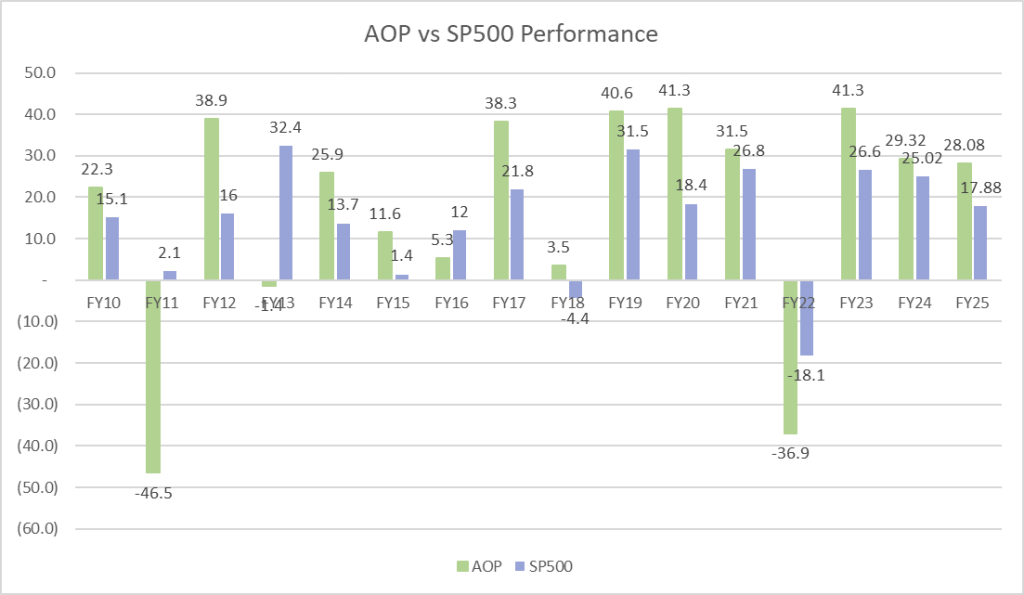

Below water-flow chart highlights how bad the negative years are in the overall performance of the fund.

Annual ups and down in the bar chart.

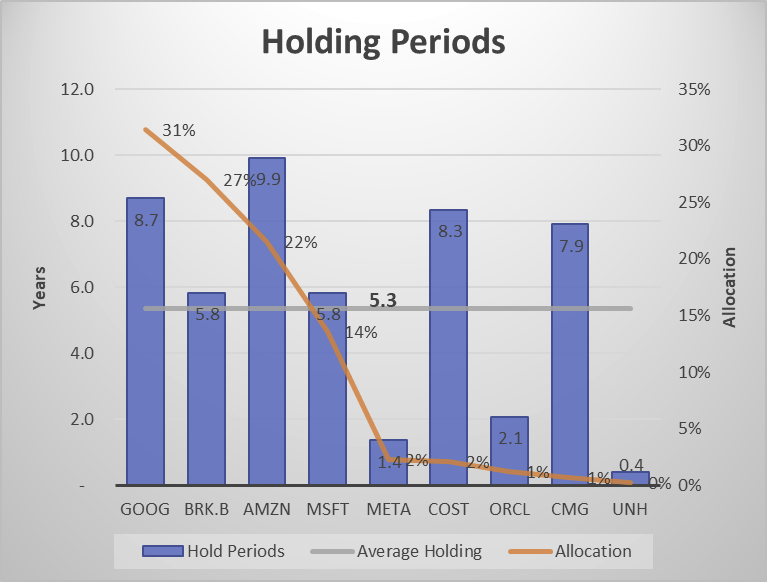

Our favorite metric, i.e. average holding period has increased to average of 5.3 years. Our longest held investment is Amazon. Amazon is in our retail shop since 2016. Almost a decade and almost 10 bagger. This year, we initiated a small position in United Healthcare (UNH), which brought down the holding period by a little bit. More on this on our future posts.

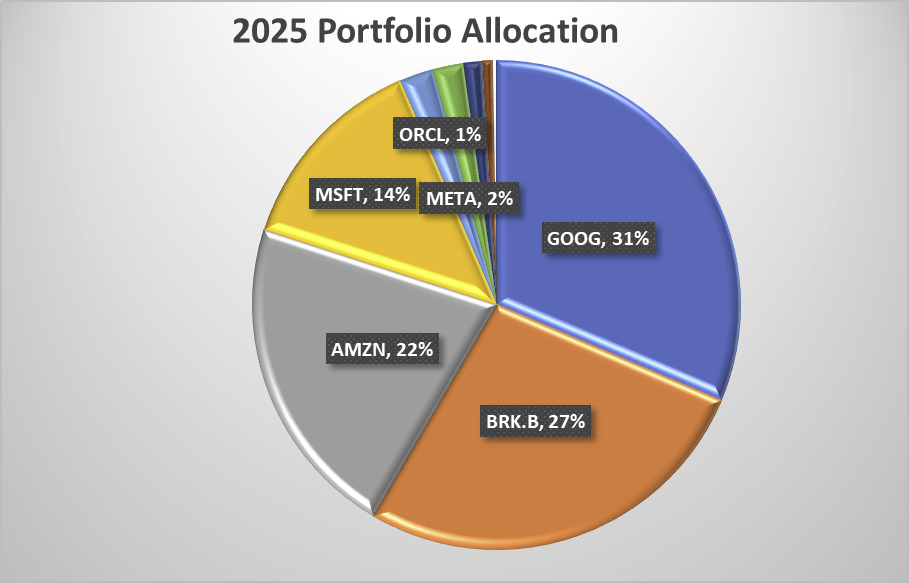

Our conviction on our top 4 holdings has stayed the same in 2025. In-fact, the total weight of top 4 holding has increased to 93% in 2025 from 89% in 2024.

With outstanding gain of 66% and some additional allocation, Alphabet has rocketed to the top position from third from last year. It is now 31% of our total holding. Same thing with Berkshire Hathaway. Amazon gained just 5.2%, which is well below the benchmark performance and therefore slide down to third position. With a slide under-performance Microsoft’s allocation fell a percentage to 14%.

Growth Engine

All four companies grew its top and bottom line in 2025. And they share top notch operating margin and Return on Invested Capital.

Although at this level, their valuations seems a bit stretched. Out of those four, Berkshire seems to have relatively low valuation.

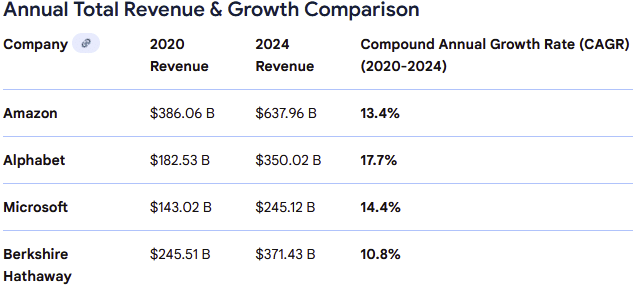

In 2020, they used to bring in around $1 Trillion of revenue and in 2024, they bring in $1.6 Trillion of total revenue, compounding at double digits.

Three of those giants are investing heavily on AI and cloud computing. Hopefully, that will yield even more return in the future.